Investing in Gold

Introduction to Gold Investing

Gold. It’s more than just a shiny metal. It’s a symbol of power, wealth, and, most importantly, financial security. For centuries, gold has captivated the attention of investors, kings, and empires alike. In a world where currencies can crash and economies can falter, gold has been the constant—a timeless asset that holds value when everything else falls apart. But is gold really worth investing in today? Let’s dive into why this ancient metal still plays a pivotal role in modern portfolios.

A Brief History of Gold as a Currency

Gold’s status as a currency dates back to ancient civilizations. From the Egyptian pharaohs who adorned themselves in gold to the Roman Empire’s golden coins, gold has always been a global medium of exchange. Over millennia, the yellow metal has gone from being a luxury to being the backbone of national currencies. While we’ve moved beyond the gold standard, the metal’s allure remains unshaken. It still anchors economies, offers a hedge against inflation, and stands as a safe-haven investment.

Why Gold is a Safe Haven Asset

When the stock market crashes, when real estate bubbles pop, when cryptocurrencies nosedive, where do investors run? Gold. It’s the classic “safe haven” for good reason. Gold isn’t tied to any single economy or government, making it immune to the whims of fiscal policies. During times of economic instability, whether caused by financial crises or political turmoil, gold tends to hold its ground—or even rise. It’s the anchor in a stormy sea of assets.

Physical Gold vs. Paper Gold: Understanding Your Options

There are two main ways to invest in gold: you either own the physical metal, or you invest in paper assets like gold ETFs or certificates. Physical gold comes in forms like bars and coins, which you can hold in your hand, while paper gold allows you to invest without the headache of storage. Each option has its perks. Holding physical gold gives you something tangible—real wealth. But paper gold offers convenience and liquidity, making it easier to trade.

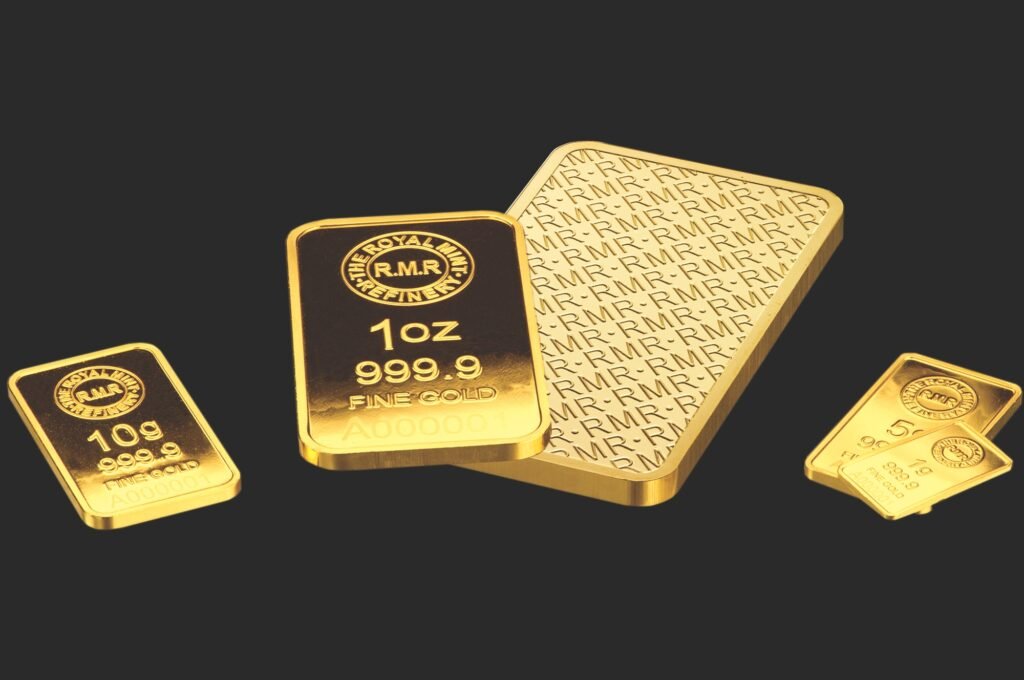

Gold Bullion: The Foundation of Gold Investing

When most people think of investing in gold, they picture heavy, gleaming bars of bullion. These bars are the bedrock of gold investing, offering the purest form of the metal. For investors looking to hold physical gold as a hedge against uncertainty, bullion is the most straightforward option. It’s pure, it’s tangible, and it’s recognized globally. The simplicity of bullion is what makes it so attractive: no frills, just gold in its most raw form.

Gold Coins: Collectibles or Investments?

Gold coins bring an additional layer of complexity to gold investing. Some investors see coins like the American Eagle or the Canadian Maple Leaf as more than just gold—they’re historical artifacts. While gold bullion is all about the raw value of the metal, coins can carry a premium based on rarity, age, and design. Collectible coins can sometimes outperform bullion due to their scarcity, but they also introduce a level of volatility that pure gold bars don’t have.

The Role of Gold Jewelry in Investment Portfolios

Gold jewelry is an interesting hybrid. On the one hand, it’s a status symbol—a piece of wearable wealth. On the other, it’s a form of investment, albeit with added complexity. The challenge with jewelry is that you’re not just paying for the gold content—you’re also paying for the craftsmanship and brand name, which may not hold their value the same way pure gold does. That said, high-end gold jewelry from top designers can appreciate over time, but it’s a gamble compared to bullion or coins.

Understanding Gold ETFs and Mutual Funds

If the idea of storing physical gold doesn’t appeal to you, gold ETFs (exchange-traded funds) and mutual funds offer a solution. These paper assets track the price of gold, giving you exposure to the metal without the hassle of storage and insurance. ETFs, in particular, allow for easy trading, making them a popular choice for those who want to buy and sell gold quickly. They’re ideal for investors who want liquidity and lower transaction costs.

The Influence of Central Banks on Gold Prices

You can’t talk about gold without mentioning central banks. These institutions hold massive gold reserves and their buying or selling can have a massive impact on gold prices. When central banks increase their gold holdings, it signals confidence in the metal’s value, often driving prices higher. Conversely, when they dump gold onto the market, it can cause prices to drop. Understanding central bank activity is key to predicting long-term gold price trends.

The Impact of Global Events on Gold Prices

Gold thrives in chaos. Wars, political instability, pandemics—these are the events that send investors flocking to gold. When uncertainty strikes, people want to hold something real. Gold is the ultimate hedge against uncertainty. In recent years, events like Brexit, the COVID-19 pandemic, and the U.S.-China trade war have all contributed to significant spikes in gold prices, reinforcing its reputation as a crisis commodity.

How to Buy Gold: Dealers, Brokers, and Online Platforms

Buying gold can be a tricky business. Whether you’re purchasing physical gold or investing in paper gold, you need to find a reputable seller. Dealers and brokers have traditionally been the go-to options, but in today’s digital age, there are also numerous online platforms offering competitive pricing. The key is to ensure authenticity and avoid counterfeits—especially when purchasing physical gold.

Storage Solutions: Keeping Your Gold Safe

So you’ve bought your gold—now what? Where you store it is almost as important as what you buy. Home safes can work for small amounts, but they don’t offer the same security as vaults or third-party storage facilities. Some investors prefer to keep their gold in bank vaults or secure storage with companies specializing in precious metals. Storage fees can eat into your profits, but they’re a necessary cost for peace of mind.

Gold’s Role in Diversifying a Portfolio

No matter how diversified your portfolio is, gold should always have a place in it. Gold balances out the risks associated with stocks, bonds, and real estate. When the economy dips, gold typically rises, making it an excellent hedge against market volatility. It’s not about putting all your eggs in one basket—it’s about having a safety net when the bottom falls out.

Inflation Protection: Gold as a Hedge Against Currency Devaluation

Inflation erodes the value of paper money, but gold has historically been a reliable store of value. When currencies lose their purchasing power due to inflation, gold tends to retain its worth—or even appreciate. For investors concerned about long-term financial security, gold offers a way to preserve wealth in times of rising inflation.

The Environmental and Ethical Implications of Gold Mining

Gold mining comes with a hefty environmental price tag. From deforestation to toxic waste, the process of extracting gold is far from clean. Ethical concerns also arise, particularly in regions where gold mining is linked to human rights abuses. Investors increasingly want to know the source of their gold, leading to the rise of ethical gold—produced with minimal environmental impact and fair labor practices.

How to Time the Gold Market

Timing the gold market is no easy feat. Unlike stocks, gold doesn’t pay dividends, so the key to profiting from gold is buying low and selling high. But how do you know when to jump in? Some experts recommend keeping an eye on geopolitical events, inflation rates, and central bank activities. Others suggest buying gold as a long-term hedge, ignoring short-term fluctuations entirely.

The Risks of Gold Investing

Gold is a safe-haven asset, but that doesn’t mean it’s without risks. Prices can be volatile in the short term, driven by speculators, market trends, and macroeconomic factors. There’s also the risk of fraud—counterfeit gold coins and bars are more common than you’d think. And then there’s liquidity—selling physical gold can sometimes be a slow process, especially if you don’t have the right buyers lined up.

Tax Considerations for Gold Investors

Investing in gold isn’t tax-free. When you sell gold for a profit, you’re likely to be hit with capital gains taxes. The rate you’ll pay depends on how long you’ve held the gold and your country’s tax laws. Some countries have favorable tax treatment for gold, while others don’t, so it’s crucial to understand the tax implications before diving in.

Historical Gold Price Trends

Gold prices have experienced their fair share of ups and downs. From the gold rushes of the 19th century to the boom periods of the 1970s and 2000s, the price of gold has been anything but static. However, the long-term trend has been one of growth. Key events, such as the 2008 financial crisis, saw gold prices skyrocket as investors sought refuge from collapsing markets.

Conclusion: The Enduring Value of Gold

Gold is timeless. It has outlasted empires, weathered economic crises, and remains as valuable today as it was thousands of years ago. Whether you’re looking for a hedge against inflation, a safe haven during volatile times, or just a way to diversify your portfolio, gold offers a unique combination of stability, rarity, and resilience. In an unpredictable world, gold remains a solid bet for savvy investors looking to protect and grow their wealth.