Gold Shines Bright in 2025: Biggest Surge Since the Financial Crisis

Talk about a golden comeback! As we wrap up the first half of 2025, gold has delivered its strongest six-month…

Gold Surge Continues

Gold’s New High: When Fear Meets FOMO on the Global Stage Gold just did it again—surging to near-record highs as geopolitical…

Gold Holds Above $3300 as De-Dollarization Accelerates and US Debt Concerns Mount

Gold prices remained steady on Monday, hovering just above $3300 per ounce, as global investors weighed rising US debt levels,…

Fresh Record Gold Prices Impact Physical Demand Amid China’s Stimulus

Gold prices surged to new all-time highs, driven by China’s recent monetary stimulus and global market dynamics. Here’s a breakdown…

Chinese Consumers Turning Away From Gold: What’s Behind The Shift?

Recent financial reports from two of Greater China’s largest jewelry houses, Chow Sang Sang and Chow Tai Fook, reveal a…

Investing in Gold: A Complete Guide to Gold Bullion, Coins, ETFs & More

Why Gold Investment Still Shines Today

Gold isn’t just a shiny relic of the past—it’s a proven store of value that has weathered financial storms for centuries. In uncertain markets, gold provides a hedge against inflation, currency devaluation, and geopolitical risk. Whether you’re a seasoned investor or just starting out, investing in gold can offer long-term financial security.

A Quick History of Gold as a Global Currency

From ancient Egyptian tombs to Roman coins to modern central banks, gold has always had monetary significance. Though we’ve moved away from the gold standard, central banks still hold massive reserves. This historical continuity reinforces gold’s enduring reputation as a reliable financial anchor.

Gold as a Safe-Haven Asset

During stock market crashes, recessions, and global crises, investors turn to gold. Why? Because gold is a safe-haven asset—it’s not tied to any single currency or economy. It retains its value when other investments fall apart, making it a cornerstone for defensive investing.

Physical Gold vs. Gold ETFs: Which Is Right for You?

When it comes to gold investment, you have two main options: physical gold (like bullion and coins) or paper gold (such as gold ETFs and mutual funds). Physical gold offers tangible security and no counterparty risk. ETFs, on the other hand, are convenient, liquid, and easy to trade.

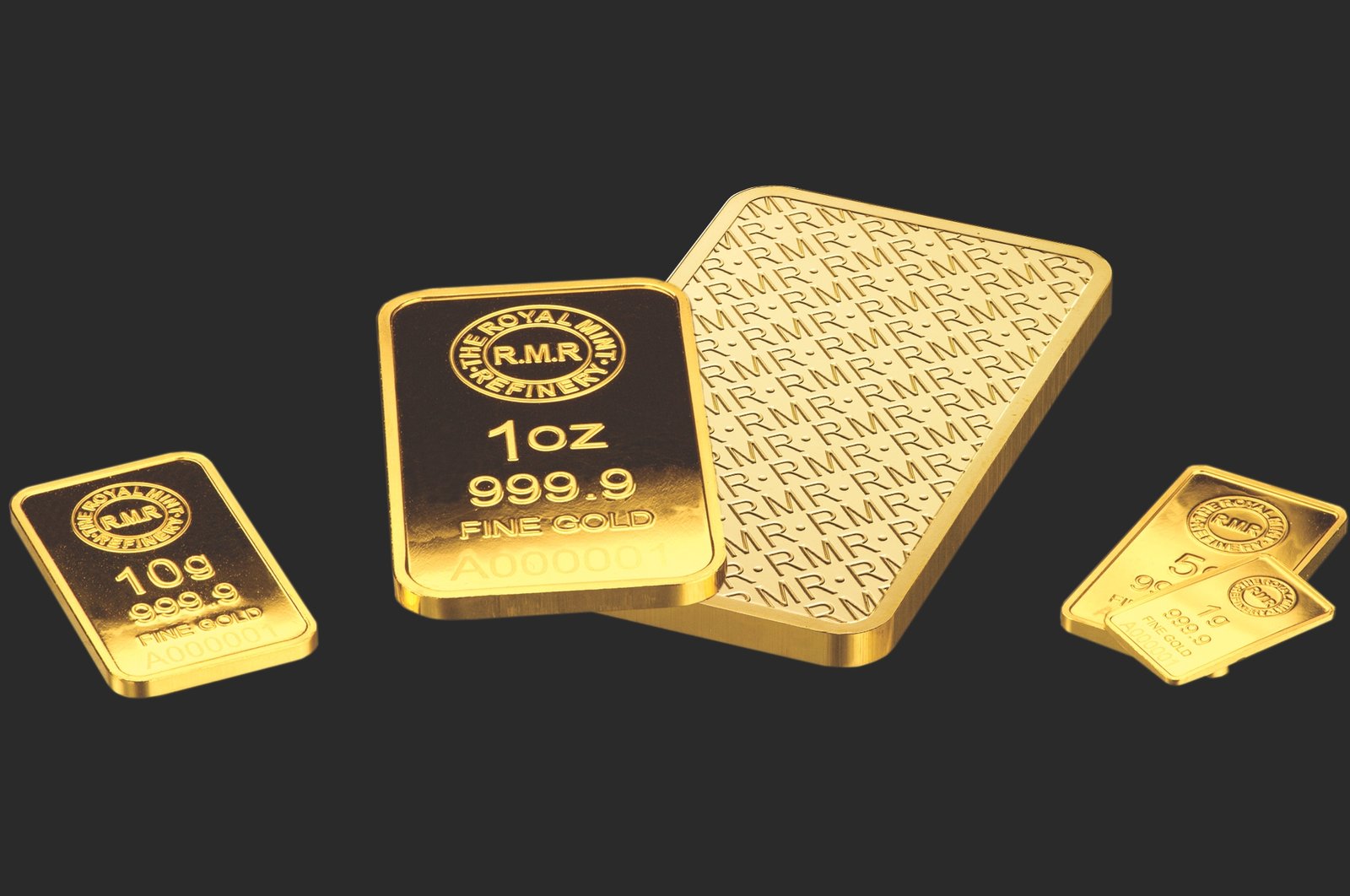

Gold Bullion: The Purest Gold Investment

Gold bullion—typically in the form of bars or ingots—is the most direct and traditional way to invest in gold. Bullion offers high purity (usually .999 or better) and is universally recognized as a stable store of value. It’s ideal for those seeking long-term wealth preservation.

Gold Coins: Valuable Assets with a Story

Gold coins such as the American Eagle or Canadian Maple Leaf offer both investment value and collectible appeal. While they generally contain less gold per unit than bullion, their historical and artistic significance can lead to higher resale premiums. They’re ideal for investors who want a mix of liquidity and beauty.

Gold Jewelry: Wearable Wealth or Flawed Investment?

Gold jewelry straddles the line between personal luxury and financial asset. However, investment returns are diluted by fabrication costs and retail markups. While certain high-end pieces may appreciate, jewelry is generally not recommended as a primary gold investment.

Gold ETFs and Mutual Funds: Smart, Simple Exposure

Gold ETFs (exchange-traded funds) track the price of gold and are traded like stocks. They provide easy access to the gold market without the complications of storage and insurance. For investors seeking liquidity, transparency, and low fees, ETFs are a strong option.

How Central Banks Influence Gold Prices

Central banks play a significant role in gold market trends. When major economies increase their gold reserves, it signals a lack of confidence in fiat currencies—often pushing prices higher. Conversely, selling off reserves can flood the market and cause dips.

Global Events and Gold Price Movements

Gold prices often spike during times of crisis—think wars, pandemics, or financial meltdowns. Investors view gold as a hedge against uncertainty. Recent examples include the COVID-19 pandemic and geopolitical tensions, which triggered sharp upticks in gold demand.

How to Invest in Gold: Dealers, Brokers & Online Platforms

Buying gold today is easier than ever. Reputable gold dealers, online brokers, and digital platforms offer various ways to purchase both physical and paper gold. Always verify authenticity and look for secure payment and delivery methods to avoid scams.

Gold Storage Options: Keeping Your Investment Safe

Storage is critical when investing in physical gold. Options include home safes, bank safety deposit boxes, or third-party secure vaults. Each comes with its own risk/reward profile and cost structure. Always prioritize security and insurance.

Diversifying Your Portfolio with Gold

Gold adds balance to a portfolio heavily weighted in stocks, real estate, or bonds. Because it often moves inversely to traditional markets, gold helps mitigate losses during downturns. Experts recommend allocating 5–10% of your portfolio to gold.

Using Gold to Hedge Against Inflation

One of gold’s biggest selling points is its ability to act as a hedge against inflation. When currency loses purchasing power, gold tends to retain—or increase—its value. This makes it an attractive choice for long-term wealth protection.

Ethical Gold Investing: What You Need to Know

Gold mining has significant environmental and ethical concerns, from deforestation to unsafe labor practices. Today’s investors can choose ethical gold—sourced responsibly with minimal ecological and social harm. Look for certifications like Fairtrade Gold.

Can You Time the Gold Market?

Timing any market is risky, and gold is no exception. Prices are influenced by global events, currency fluctuations, and investor sentiment. Some prefer dollar-cost averaging—investing a fixed amount regularly—rather than trying to buy low and sell high.

Risks of Gold Investing

Gold is not risk-free. Prices can fluctuate based on market speculation, and selling physical gold may involve delays and additional fees. Counterfeit coins and fraud are also concerns. Stick with trusted sellers and diversify your holdings.

Gold Taxes and Capital Gains: What to Expect

In many countries, profits from selling gold are subject to capital gains tax. The rate depends on how long you hold the asset and your tax bracket. Consult with a financial advisor or tax professional to avoid surprises.

Gold Price Trends Through History

Historically, gold prices have risen over the long term, with notable spikes during inflationary periods and financial crises. From the 1970s to the post-2008 era to recent highs, gold has proven to be a resilient and valuable asset.

Final Verdict: Is Gold a Good Investment?

Gold remains one of the most reliable investment assets in the world. Whether you want to hedge against inflation, diversify your portfolio, or prepare for economic uncertainty, gold offers a mix of security, liquidity, and long-term value.