Gold Surge Continues

Gold’s New High: When Fear Meets FOMO on the Global Stage Gold just did it again—surging to near-record highs as geopolitical…

Gold Holds Above $3300 as De-Dollarization Accelerates and US Debt Concerns Mount

Gold prices remained steady on Monday, hovering just above $3300 per ounce, as global investors weighed rising US debt levels,…

Fresh Record Gold Prices Impact Physical Demand Amid China’s Stimulus

Gold prices surged to new all-time highs, driven by China’s recent monetary stimulus and global market dynamics. Here’s a breakdown…

Gold Bullion: The Timeless Investment for Wealth Preservation

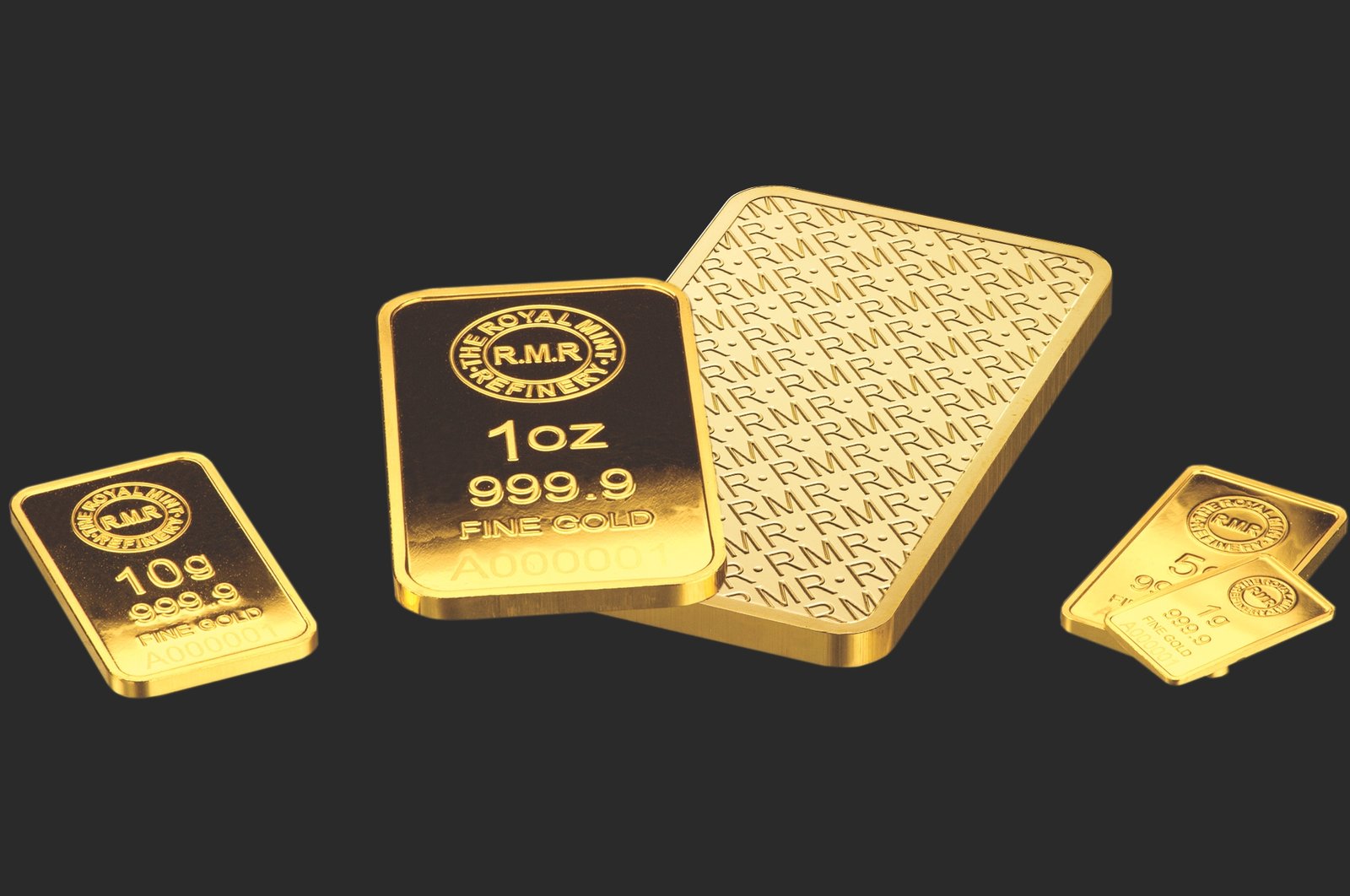

What Is Gold Bullion?

Gold bullion refers to pure physical gold—usually in the form of bars or coins—valued primarily for its weight and purity. Unlike gold jewelry, which includes added craftsmanship and design costs, bullion is priced based solely on the current gold spot price. Investors around the world choose gold bullion as a secure, tangible store of value in uncertain economic times.

Why Gold Bullion Is a Safe Haven Asset

During financial crises, market volatility, or inflation spikes, gold bullion shines. It is not tied to any government, corporation, or currency—making it a reliable hedge against inflation, currency devaluation, and geopolitical risk. When paper assets falter, physical gold bullion tends to hold or even increase in value.

A Brief History of Gold Bullion

Gold has played a vital role in global finance for thousands of years. Ancient civilizations like the Egyptians and Romans used gold as currency. In the modern era, the gold standard anchored global currencies to physical gold. While fiat systems have replaced it, gold bullion remains central to central bank reserves and investment strategies.

How Gold Bullion Is Made

Gold bullion is produced by refining gold ore into pure gold, usually 99.5% or higher in purity. This refined gold is then cast into bars or struck into coins by mints. Each bullion piece is stamped with identifying marks—such as weight, purity, and serial numbers—to verify authenticity and facilitate global trade.

Gold Bullion vs. Gold Jewelry

Gold jewelry may be beautiful, but it’s not an efficient investment. Jewelry comes with markup costs for design and labor, and resale values can vary. Gold bullion, however, focuses on purity and weight—making it easier to value, trade, and liquidate when needed.

Types of Gold Bullion: Coins and Bars

Popular gold bullion coins include:

- South African Krugerrand

- American Gold Eagle

- Canadian Maple Leaf

- Austrian Philharmonic

Gold bars range in size from small 1-gram bars to large 1-kilogram bars, commonly produced by trusted mints like PAMP Suisse, Valcambi, and the Royal Mint.

How Gold Bullion Is Valued

The value of gold bullion is determined by:

- Weight (in troy ounces or grams)

- Purity (typically 99.9% or 24 karats)

- Current spot price of gold

Market prices fluctuate based on global demand, central bank activity, and economic indicators.

Central Banks and the Gold Bullion Market

Central banks hold vast gold reserves to hedge against currency risk and bolster financial stability. Countries like the U.S., China, and Russia influence global gold prices through their bullion purchasing strategies—often signaling shifts in market sentiment.

How to Buy Gold Bullion

You can buy gold bullion from:

- Reputable dealers or brokerages

- Online bullion retailers

- Vaulted services that offer digital ownership of physical gold stored securely

Always verify the dealer’s reputation, check for certifications, and compare pricing close to the gold spot rate.

Gold Bullion Storage Options

Choose the storage method that fits your risk tolerance:

- Home safes: accessible but vulnerable to theft

- Bank safety deposit boxes: secure, though with access limitations

- Professional vault services: fully insured and ideal for high-value holdings

Risks of Investing in Gold Bullion

While gold is a relatively stable asset, risks include:

- Price volatility

- Storage and insurance costs

- Lack of passive income (unlike stocks or bonds)

- Liquidity delays when selling physical assets

Gold Bullion as an Inflation Hedge

Historically, gold has preserved purchasing power during periods of high inflation. When fiat currencies lose value, gold remains a globally recognized asset—offering investors a powerful hedge against economic instability.

Selling Gold Bullion

To sell gold bullion:

- Monitor the spot price for optimal timing

- Use a reputable buyer or the same dealer you purchased from

- Verify your bullion’s authenticity and condition for best pricing

If stored in a vault, many providers offer direct resale services.

Tax Implications of Gold Bullion

In many countries, profits from selling gold bullion are subject to capital gains tax. Some jurisdictions also apply VAT or sales tax on gold purchases. Always consult a financial advisor or tax expert before buying or selling.

Physical Gold vs. Paper Gold

Don’t want to store physical gold? Paper gold—like ETFs (Exchange-Traded Funds)—offers exposure to gold’s price without physical ownership. While easier to trade, paper gold lacks the security of having a tangible asset in hand.

Diversifying Your Portfolio with Gold Bullion

Smart investors use gold bullion to diversify portfolios. When equities drop, gold often rises—making it an excellent portfolio stabilizer during downturns. Experts typically recommend allocating 5–15% of your portfolio to precious metals.

Global Demand for Gold Bullion

Demand for gold bullion is driven by:

- Investment interest

- Central bank purchases

- Industrial uses

- Jewelry manufacturing, especially in markets like China and India

This global appetite keeps gold in high demand and supports its long-term value.

Ethical Considerations and Environmental Impact

Gold mining can be environmentally destructive and raise ethical concerns. More investors are seeking ethically sourced gold, including recycled gold bullion and products certified by sustainability initiatives.

The Future of Gold Bullion

As inflation rises and digital currencies proliferate, gold bullion remains a bedrock of financial stability. It’s trusted, tangible, and time-tested—qualities that continue to make it one of the smartest investments for uncertain times.